PLEASE READ THIS IMPORTANT INFORMATION

BNY Mellon PinPoint℠ (the “tool”) is intended to be used with financial professionals who set the parameters of the analysis contained herein and is not a proposed investment strategy or a comprehensive financial plan. The content produced by the tool is being provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

By utilising the report generated from the use of this tool, financial professionals acknowledge their understanding of the following important information:

1) This information does not contain sufficient information to support an investment decision and it should not be relied upon in evaluating the merits of investing in any securities or strategy. This material does not take into account the particular investment objectives, restrictions, or financial, legal or tax situation of any specific investor, nor does it purport to be comprehensive or intended to replace the exercise of an independent review regarding any investment, asset class or other financial decision. Financial professionals are responsible for making their own independent judgment as to how to use this information.

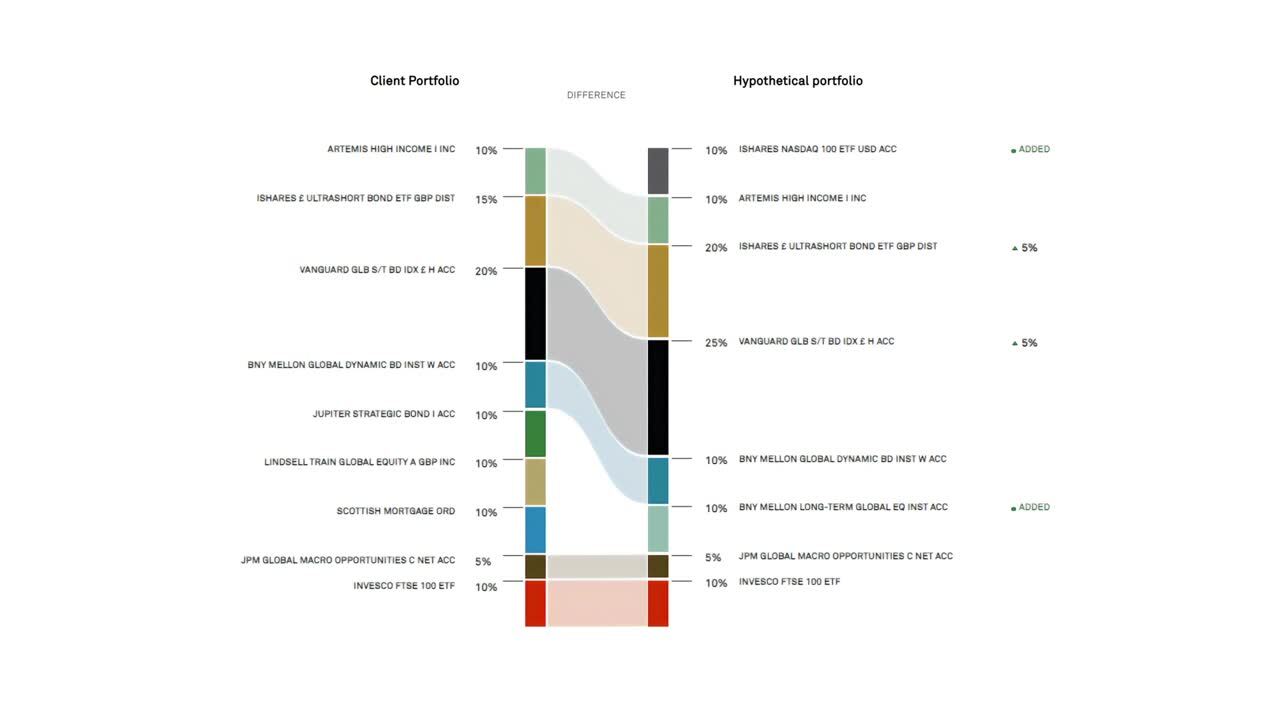

2) The projections or other information generated by the tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not a guide to future results. Results may vary with each use and over time. The tool cannot predict a portfolio or fund’s risk of loss due to, among other things, changing market conditions, or other unanticipated circumstances. Please refer to the end of the report for important information regarding the use of hypothetical performance.

3) Results from the tool are expected to include a substantial portion of BNY Mellon funds. BNY Mellon receives more revenue when an investor invests in a portfolio or asset allocation strategy that uses BNY Mellon funds over other funds. As such, BNY Mellon has an incentive to include BNY Mellon funds. Non-BNY Mellon funds are only considered for inclusion in the hypothetical portfolio if they already form part of the current portfolio or are specifically requested by the report recipient for consideration. Financial professionals should obtain any non-BNY Mellon fund information from the relevant third-party websites.

Morningstar Data

All data contained in the tool is provided by Morningstar, Inc., unless specified otherwise. Certain elements are created with MPI Stylus Pro, with data provided by Morningstar: Fund Attribution, Factor Attribution, Historical Scenarios, Regime Analysis, and Hypothetical Shocks.

Investors and their advisors should consider the investment objectives, risks, charges, and expenses of a fund carefully before investing. Please refer to the prospectus and the KID before making any investment decisions. Go to www.bnymellonim.com

The content of the tool’s report is current as of the date of creation and subject to change. Any views and opinions expressed are those of BNY Mellon unless otherwise noted and are not investment advice. This report is not investment research or a research recommendation for regulatory purposes. Stress-testing may be carried out on a portfolio to determine how it may perform if a particular market or macro-economic variable is to move. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from those shown here. The information is based on current market conditions which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained in the tool has been obtained from third party sources believed to be reliable and BNY Mellon shall not assume any responsibility for the accuracy and/or completeness of such information, including any errors or omissions. No part of the tool’s output may be reproduced in any form, or referred to in any other publication, without express written permission.

Investment Risks

All investments involve some level of risk, including loss of principal. Certain investments have specific or unique risks that should be considered along with the objectives, fees, expenses. Asset allocation and diversification cannot assure a profit or protect against loss. There can be no assurance that an investment strategy based on the tool will be successful.

Bonds are subject to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. High yield bonds involve increased credit and liquidity risk than higher rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis. Equities are subject to market, market sector, market liquidity, issuer, and investment style risks to varying degrees. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries. ETFs trade like stocks, are subject to investment risk, including possible loss of principal. Alternative strategies may involve a high degree of risk.

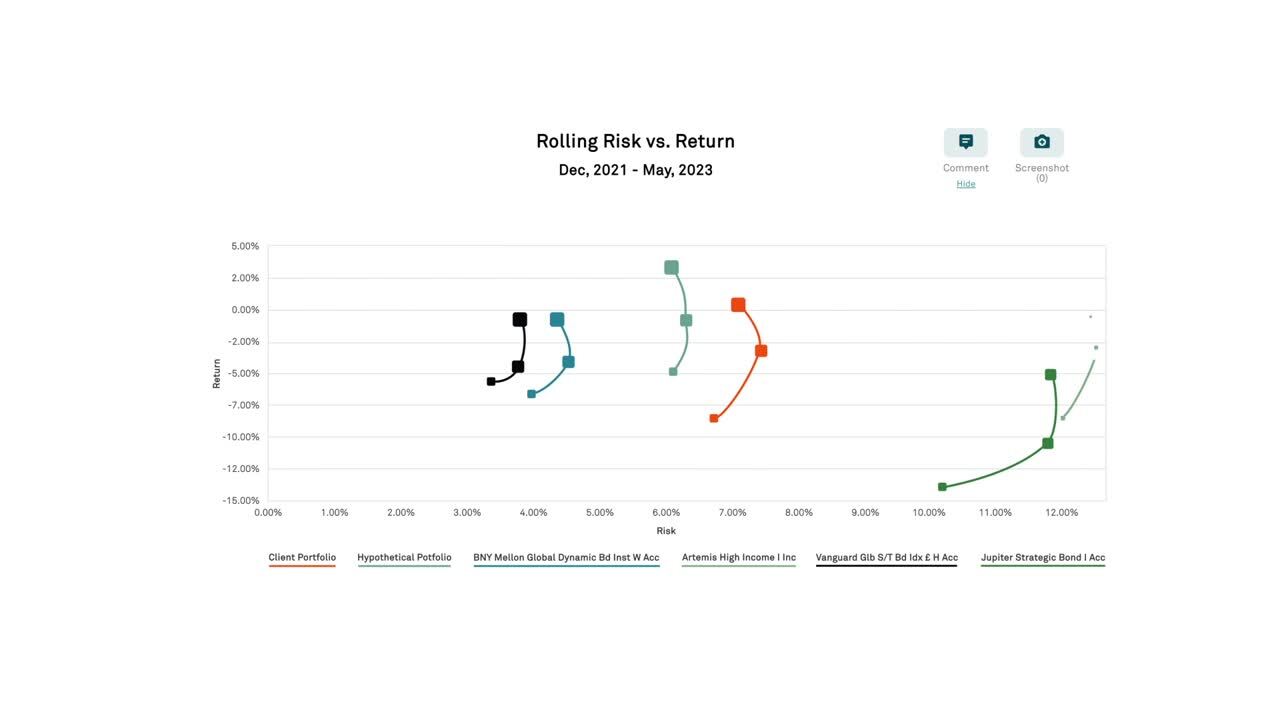

Charts are provided for illustrative purposes only. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations.

Historical Performance Information

Historical performance reflects performance of the security or asset class shown under certain parameters and over time. Please note that careful consideration should be given to assets that have short-term historic performance records, i.e. less than five years as there is limited information as to how these assets may have performed during all market conditions. Past performance is not a guide to future performance.

Hypothetical Performance Information (Portfolio Analysis only)

Information provided may illustrate the hypothetical historical performance of a current and hypothetical portfolio. While the individual asset classes and specific securities may have actual historical performance, the combination of these asset classes/securities in a current or hypothetical portfolio is new and, therefore, that combination does not have an actual performance record. Since these illustrations of the historic performance do not reflect the results of actual trading, but were calculated by the retroactive application of historical performance of the investment returns, such returns are hypothetical in nature.

Hypothetical performance results have many inherent limitations. No representation is being made that any fund or account will or is likely to achieve profit or loss. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently realized by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can adversely affect actual trading results. There can be no assurance that the portfolios will remain the same in the future, or that an application of the current portfolio in the future will produce similar results, because the relevant market and economic conditions that prevailed during the hypothetical performance period will not necessarily recur. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. All hypothetical performance results are presented for illustrative purposes only.

What If Scenarios

What If Scenarios are illustrations that aim to quantify the impact of an event or a series of events to a fund or portfolio. The historical market events, historical regime analysis and the portfolio stress testing measures the potential impact of discrete market events on a portfolio using a multi-factor statistical risk model. Based on the portfolio weightings the model determines the portfolio’s exposure to the risk factors defined in the risk model (see Risk Factor Index Definitions). The volatility of the risk factors used in the model as well as the sensitivity to the market event, regime or index is estimated using the available historical performance for the investments within the portfolio. The sensitivity of each risk factor to the discrete market event is aggregated to the portfolio’s total sensitivity to the market event. The scenarios used in this analysis may be different to those used by the fund or its investment manager for the purposes of monitoring and managing risk in accordance with the relevant laws, regulations and standards applicable to the fund and the investment manager. Reference should also be made to the risk disclosures and relevant risk indicator(s) set out in the fund prospectus and Key Information Document.

Historical Market Events: Historical Market Events illustrate hypothetical portfolio performance during actual historical events. The investment’s exposure to the risk factor model is used to recreate the portfolio and determine hypothetical historical performance during predefined time periods.

Portfolio Stress Testing: Portfolio Stress Testing illustrate hypothetical portfolio performance if a hypothetical shock were to occur today. These stress events are not necessarily tied to actual historical event but illustrate how investments might behave in stress environments.

Historical Regime Analysis: Regime Analysis illustrates hypothetical portfolio performance during actual historical market regimes. Regimes are based on historical periods that share a common characteristic or meet particular rules. Regimes are based on the trailing 25 years and are a collection of all the months that where the condition was meet. Market Factors are used to recreate the portfolio and determine hypothetical historical performance.

General Disclosures

BNY Mellon Global Funds, plc (“BNYMGF”) is an open-ended investment company with variable capital, with segregated liability between sub-funds. BNYMGF is incorporated with limited liability under the laws of Ireland and authorised by the Central Bank of Ireland as a UCITS scheme. The Management Company is BNY Mellon Fund Management (Luxembourg) S.A which is regulated by the Commission de Surveillance du Secteur Financier (“CSSF”). Registered address; 2 – 4 Rue Eugène Ruppert, L-2453, Luxembourg.

BNY Mellon Investment Management is one of the world’s leading investment management organisations encompassing BNY Mellon’s affiliated investment management firms and companies involved in the manufacture and distribution of investment products and services. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally.

No part of this material may be reproduced in any form. Not for use with the general public.