ABOUT US

Our mission is to leverage BNY Mellon’s strengths as a leading asset management, wealth management and investment servicing firm to bring Outsourced Chief Investment Officer (OCIO) and advisory solutions to institutional investors worldwide.

We serve endowments, foundations, retirement plans, family offices, governments and financial intermediaries.

Services

Capabilities

Our Process

Our scale and expertise makes all the difference

We’re delighted to announce the launch of Investor Solutions. The team comprises over 60 investment professionals with expertise across multiple areas including asset allocation and portfolio construction. By bringing together our existing capabilities into a single unit, we’re able to support our clients’ unique investment needs with greater precision.

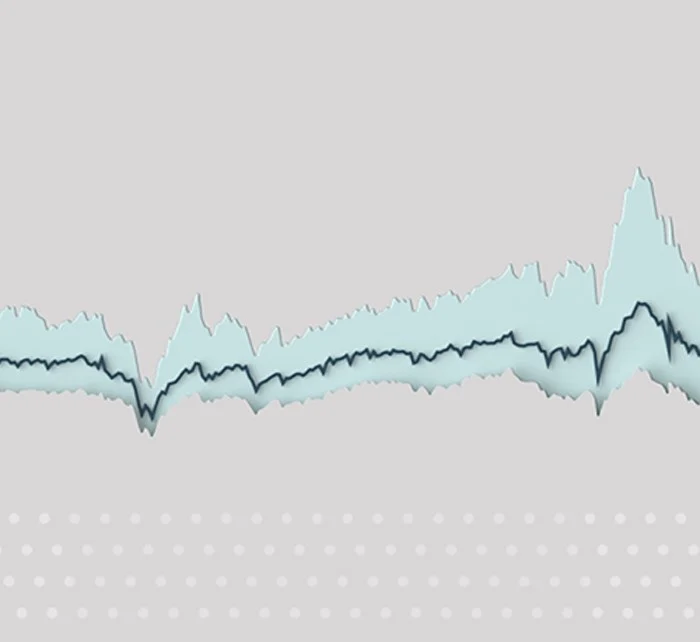

We build portfolios that seek to minimize the dispersion of investment performance around a desired outcome.

Our research and perspectives

We periodically publish research and perspectives on a range of topics, including governance, capital markets, asset allocation, portfolio implementation, client segment-specific issues and industry best practices. Below are some recent examples.

Alternative Investments 2023: Alter Your Trajectory

The economic cycle has returned, and institutional investors face many cyclical and secular challenges. In this paper, we explore eight themes changing the course of the 60/40 portfolio.

10-Year Capital Market Assumptions

Every year, BNY Mellon Investor Solutions develops capital market return assumptions for approximately 50 asset classes around the world. The assumptions are based on a 10-year investment time horizon and are intended to guide investors in developing their long-term strategic asset allocations.

The path to robust strategic asset allocation

Two keys to a portfolio design process that can fulfill multiple, competing objectives are an adaptable research philosophy and a flexible technology platform. In this paper, Keith R. Collier, CFA, Director of Asset Allocation Research, explains the evolution of the BNY Mellon Investor Solutions approach to strategic asset allocation (SAA) – from the artisanal to the systematic – and how that journey led to the development of a unique robust SAA methodology that can stand the test of time.

Read More

Operational Due Diligence - FAQs

The Operational Due Diligence Team at BNY Mellon Investor Solutions, LLC is dedicated to evaluating the business, operational, compliance and fund structure risks of prospective and current managers for client accounts. Our process is independent, yet complementary, to the manager research process, which examines investment risks. In this paper we outline our ethos, process and practice – encompassing our current focus amid today’s challenging backdrop of heightened risks and restrictions on company visits.

Investment Manager Assessment: Diversity, Equity, & Inclusion (DEI)

In this white paper, BNY Mellon Investor Solutions describes its holistic DEI evaluation approach for investment manager assessment that includes firm and strategy considerations.

Designing robust strategic asset allocations under constraints and uncertainty

Today’s institutional investors require strategic asset allocations (SAAs) resilient to long-term uncertainty. The concept of “robust” portfolios that reduce shortfall risk – even when the future doesn’t go entirely as planned – can help address this challenge. In this paper, Keith R. Collier, CFA, Director of Asset Allocation Research, provides an overview of BNY Mellon Investor Solutions’ Robust SAA Design process and highlights specific innovations that differentiate our approach from conventional methods.

Alternative Risk Premia: An Alternative to Alternatives

An emerging area of interest for investors, academia and practitioners, we examine how diversified alternative risk premia (ARP) strategies may serve as a replacement for certain hedge fund exposures within a portfolio, offering both a lower fee and favourable diversification benefits. This paper, authored by James Podder, CFA, CAIA and Jasmine Yu, PhD, CFA, CAIA, defines and outlines ARP and the role it can play in diversified portfolios.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

CAIA® and Chartered Alternative Investment Analyst® are registered trademarks owned by the CAIA Association.

Get to know our Investor Solutions experts

Our Investor Solutions team have experience across research, asset allocation, portfolio construction, risk management and more. Their combined expertise means we can offer you a complete service across every aspect of the investment process.

View our team biographies to learn more.

Contact Us

If you would like to learn more about BNY Mellon Investor Solutions, please send us an email and we will respond shortly.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.